Cryptocurrency is on the rise. A precarious rise, but a rise all the same.

Since first being theorised by computer engineer Wei Dai in 1998, the decentralised cryptotech economy primarily established around bitcoin is now worth billions of dollars. Debate around its security and ease of use have been waging since inception, and have lead to governments, bankers, economists and citizens questioning the future of digital currency. Is such an idle stance on the topic ideal, considering the modern pace of tech advancement?

To answer the question, we must first understand the history of the systems involved.

Over 700 cryptocurrencies have been developed since 2009, but only nine of these have a capital value over $10 million USD. The most stable of these is the progenitor of the concept: Bitcoin.

Established in 2009 by Satoshi Nakamoto (commonly believed to be a pseudonym for Craig Steven Wright, a former Australian academic who admitted he was the founder, only to recant later), Bitcoin is a $5 billion USD market that, at its peak, was worth as much as the world’s entire silver stock.

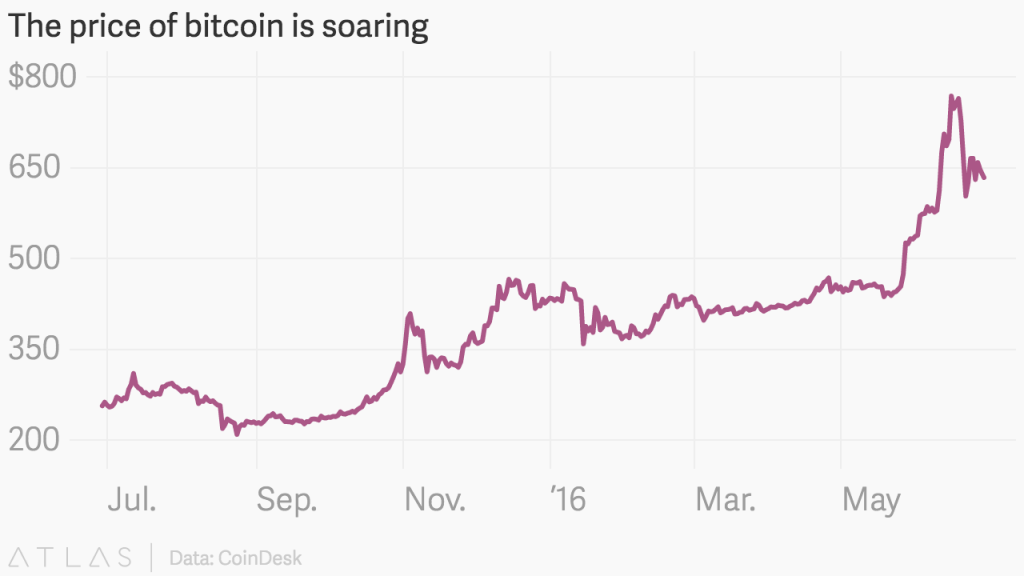

Though value fell fast in the face of extreme government pressure, especially from China, as well as the rise of competitors like the capital-allocation community of Ethereum, bitcoin has seen a resurgence over the last month. Volatility is attractive to investors in the world of cryptocurrency, and that has buoyed value to triple what it was back in June 2015.

Though bitcoin is usually perceived as the payment option of choice for shady individuals, the truth is that acceptance of the currency has flourished in the mainstream. Electronics suppliers like Dell, NewEgg, and even Microsoft allow bitcoin as a payment option, as do several hotel booking services, jewelers, sport franchises and, perhaps, your local cafe.

Outside of those using the system for transactional purposes are the miners. To maintain proof that bitcoin transactions are legitimate, and allow the tech to operate efficiently, miners are tasked with creating blockchains; parts of a public digital ledger that records all bitcoin usage. As a reward, miners are paid in bitcoin, but the formulation of a blockchain is a timely, energy-intensive process, so it’s impossible for many individuals to mine for substantial profit on basic computers. That’s why facilities like this one in northeast China have been established, allowing four people across six sites to harvest up to $1.5 million USD in bitcoin each month.

Such practices are the very reason rumours about the legitimacy of cryptocurrency exist. Detractors – most notably the European Commission (EC) – paint pictures of an underbelly using bitcoin anonymously for such misdeeds as tax avoidance and the funding of terrorist activities in an attempt to bring restrictions upon it.

In fact, the real fear derives not from what the EC says, but what the EC does. Namely, the EC’s action plan is designed to keep power in the hands of the banks. No cryptocurrency is anonymous in any substantial degree – blockchains mean records are created and validated – and virtual currency is taxable like any form of income, even if users attempt to hide their earnings.

As for the issue of terrorism, cash is far more likely to be used to pay for such activity, and as Germany learnt earlier this year, limiting the use of such basic currency is never going to be a viable option.

Users are quick to recount myriad scenarios that prove the importance of a currency system free from third-party intervention. The most popular of these dates back to 2010, when Paypal, Visa, and Mastercard prohibited customers from sending donations to WikiLeaks. The providers, under pressure from the US government, excused the action by point to a section of customer contracts which essentially declared Wikileaks an illegal operation.

American users also point to the Social Security Number system implemented in the 1930s. At that time, the Social Security Administration explicitly declared that SSNs would not be used for the purpose of identification, at a time when the government was repeatedly pursuing a national identification system. Of course, that quickly changed.

Cryptocurrency is founded on the basis of liberty from centralised systems that have singlehandedly allowed such tragedies as the 2008 Global Financial Crisis to occur. Without that freedom, the modern tech has little future.

That is some time away though. At present, the fear remains with the governments and banks trying to adapt to the system at their traditionally glacial pace. The banking system has had little need to innovate in its centuries of existence, but it must now if it hopes to survive. Clamping down on cryptocurrency will not help these powerful institutions overcome the revolution; it will only fan the flames.

So should we fear a cashless world? Either answer seems valid at present, but that will not be the case forever. Cryptotech must find the balance between security, ease of use, and openness to continue fostering a user base, while the banking system and government must find a way to work with, not against, those providing an alternative to traditional, self-serving policies that doesn’t involve stashing a fortune under a mattress.

What do you think about the future of cryptocurrency? Let us know in the comments.